Hotel Exit Cap Rates & Risk

Why cap rates for Hotels are higher than other asset classes

Why are cap rates for

Hotels higher than the other primary

asset classes?

The most common answer I receive is simply "risk". On the surface, it appears to make logical sense. People always need a place to live, and a place to work, and to buy stuff but do they really need to travel ?

As we enter 2026, riding the wave of a turbulent 5-year stretch, is our understanding of CRE asset risk still accurate?

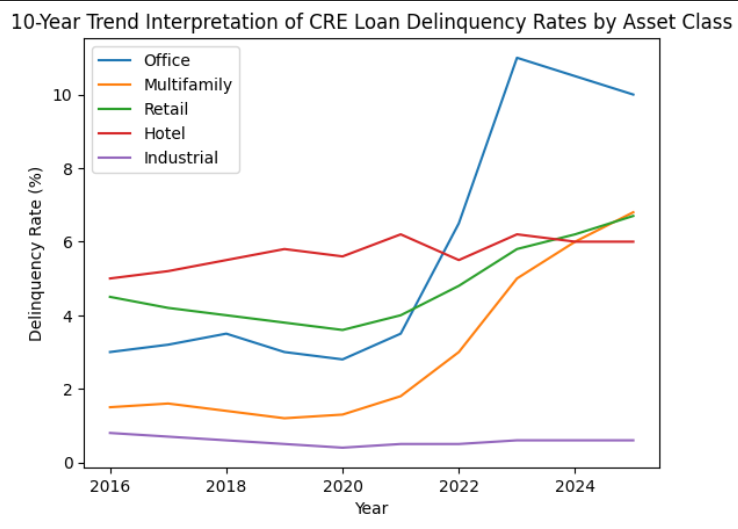

Remote work has upended office; A glut of new supply,declining birth ratesand cost of living backlash suggests a coming reckoning for multi-family, and the Amazon effect of shopping continues to impact the world of retail - this is also reflected in the continued strength of Industrial as an asset class, which is directly tied to these super power online retailers.

As of 2025, hotelCMBS Loan Delinquencyis now below all but the industrial asset class.

So, is it really "risk" that leads the market to apply a higher cap rate, or perceived risk?

If the latter, what drives that perception?

COMPLEXITY

It is the complexity of the unique nature of a hotel, where you not only must execute on a real estate deal - identify a market, acquire the site, construct the building - but must also operate a living breathing profit and loss, cash producing business.

Building the hotel is just the first step.

Every day requires dedication to detail and an 'always be closing' mentality to win business. Pricing can change hourly, and every single day is a battle vs the competition to win.

Not only do you have to maintain the quality of the asset, but also the quality of the guest experience.

Anyone that suggests that hotels are not complex is either lying to you or doesn't know hotels.

But is complexity a problem to be discounted, or an opportunity to seize on?

Over the next few months and with the help of the many exceptional individuals I am fortunate to work with, I am going to spend time exploring the unique faucets of hotels that give them their layers of complexity.

This will include, but not be limited to:

-How we identify good markets and sites for hotel

-Product selection

-Construction

-Pre-opening

-Sales & marketing

-Expense management

-Exits

If you have any other topics and areas you think would be interesting to cover, please reach out on ourContact Page.