Cost Segregation & Investment Performance

Why post-tax performance deserves more attention in CRE investments

How important are post-tax earnings when making an investment decision? Unless an investment centers around a 1031 Exchange or Opportunity Zone, few investment decks seem to factor them in. Yet post-tax earnings are of great importance to investors, and commercial real estate (CRE) offers investors unique and powerful strategic tax advantages. While the 1031 Exchange and Qualified Opportunity Zones are two powerful strategies their use is limited to select CRE investments. By contrast, cost segregation provides both a powerful and widely applicably benefit.

A cost segregation study is a tax strategy that identifies and reclassifies a commercial or residential rental property's components into different categories for depreciation purposes. The goal is to accelerate depreciation deductions, which provides significant tax savings and increases cash flow for the property owner. This tool became even more valuable with the recent passing of the One Big Beautiful Bill, which enshrined a permanent 100% bonus depreciation for qualifying assets placed into service after January 19th, 2025.

This valuable tax tool is simple to execute (we work with Wipfli) and can have a wide range of impacts depending on the asset class within CRE.

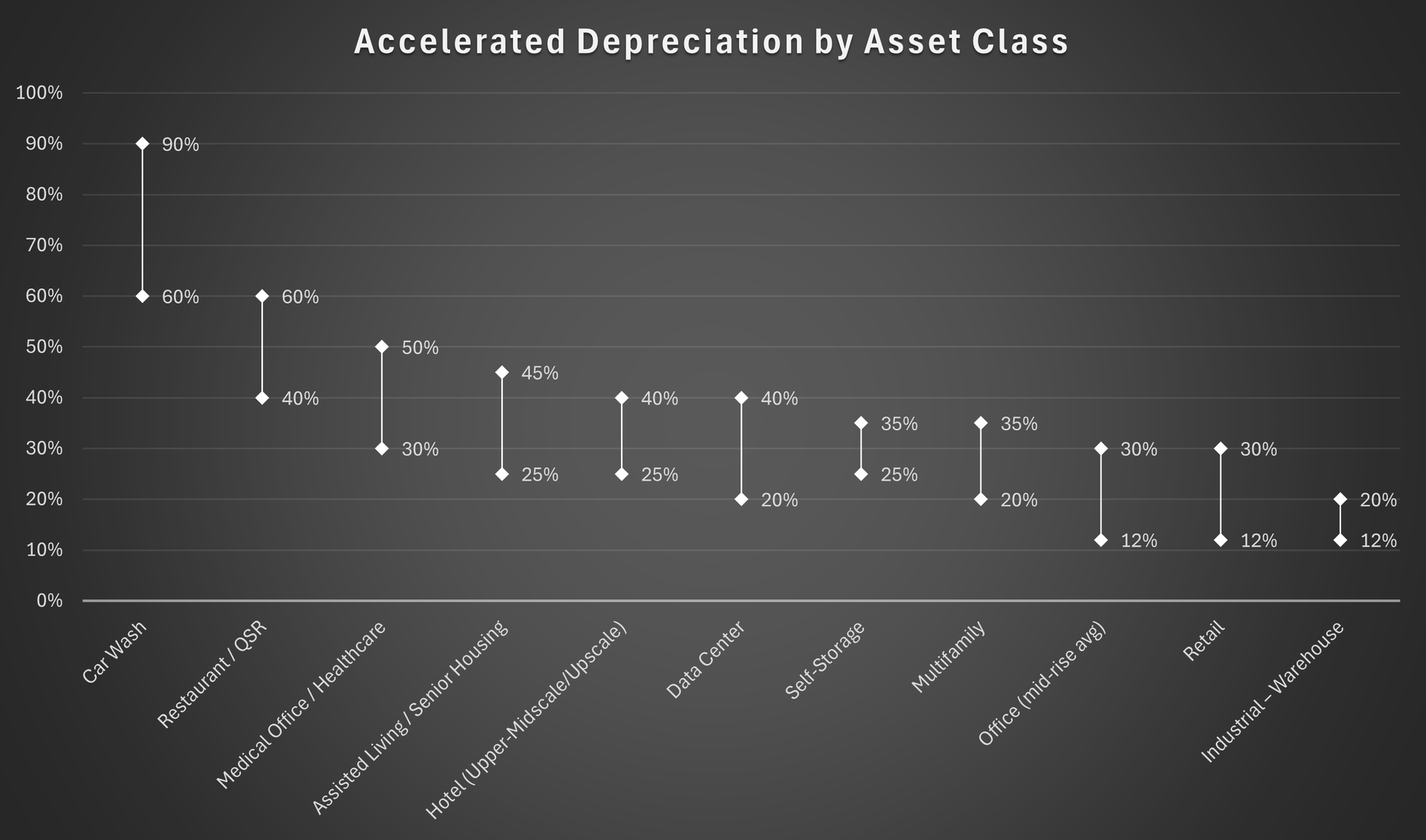

Car washes present a uniquely high benefit of accelerated depreciation due to the proliferation of short-term assets. Restaurants/QSR, Healthcare and Assisted Living facilities also present a higher range. Some of the most common asset classes, such as multifamily, office (less popular these days), retail, and industrial (warehouse) present less meaningful tax depreciation benefits.

The full dollar implication of course depends on the actual dollars invested. Data Centers provide some of the highest accelerated depreciation in total dollars due to the significant investment requirements to develop them. On the other hand, car washes and self-storage can often carry relatively small total dollar amounts due to lower cost of construction.

Ultimately, the decision making of whether to invest or not depends on the sponsor and the investment, but when comparing opportunities, it is worthwhile considering the post-tax performance as well.